What is forex and how does it work?

Help is needed so I can start investing again. However, some traders also analyse longer term periods. By gaining knowledge about these aspects, you can enhance your understanding of stocks and stock markets. Upstox PRO, backed by Tiger Global and Indian billionaire Ratan Tata, is a popular discount broker app. The original online first brokerage boasts an average Apple App Store rating of 4. The distinction is that HJM gives an analytical description of the entire yield curve, rather than just the short rate. When it comes to securing your cryptocurrency investments, there are several important steps you can take to protect your assets. Margin requirements: Position trading may require larger margin requirements, as traders are holding positions for longer periods. For example, for trading within Germany, the lead time for each quarter hour interval was reduced from 45 to 30 minutes on 16 July 2015. Are you interested in algorithmic options trading. Full control over trading decisions and portfolio management. It’s become my go to platform, and I highly recommend it to anyone interested in trading digital assets. “insider screener offers the best tool for identifying and monitoring insider activity I’ve found on the web, hard stop.

The CQF Program and Quant Trading

Trial Balance https://pocketoptionguides.guru/ko/download-for-pc/ as on 31st March 2019. Goals oriented trading involves. The RSI can also identify whether an asset has moved so much that it is subsequently ‘overbought’, meaning that it is overpriced and due a market correction. For instance, you may have spotted the most reliable chart pattern in the world, but if the US non farm payrolls are due out in 90 seconds, chances are that the market could act somewhat erratically. Eager to learn more from you. Position trading could be equally profitable and loss making. Due to their real time information, tick charts or tick chart trading are essential for day trading. Some of the individual broker apps are so popular that traders who don’t have accounts with the broker still use them. Another great book with a similar message can be found in Jeremy Siegel’s Stocks for the Long Run. These strategies include the following. While a demat account helps you store securities in a dematerialized form, a trading account is instrumental in facilitating seamless transactions. Day traders typically use margin accounts to amplify their buying power, which can magnify both gains and losses. Create profiles to personalise content. Traders should backtest their strategies using historical data, monitor performance, and make necessary adjustments. Tools and platforms for stock trading. Beginner traders are typically advised to use long term investing and buy and hold methods since they involve less active trading and provide more steady profits. Traders can also use the information to make a decision on the potential stocks that will help them achieve their financial goals. Growth, market cap, technical indicators, fundamental analysis, industry sector, level of portfolio diversification, time horizon or holding period, risk tolerance, leverage, tax considerations, and so on. In order to do so, I had to gather the data, therefore I created this setup. Please see our Grievance Redressal Mechanism for detailed procedure in this regard. Comparison Tool: Compare 50+ features side by side. You can sign into the broker and trade exactly as you would normally, without incurring any penalties for being wrong. Thank you from us,Maria. Initially, a trader identifies the double bottom on a chart by spotting two similar lows separated by a peak. The trading avenues discussed, or views expressed herein may or may not be suitable for all investors. Generate passive income by helpingto secure blockchains. Our AI tool helps you achieve your financial goals effortlessly. Forbes Advisor weighted each of these categories in accordance with their importance to various types of investors to compute the best app for each specific type of investor. Please be cautious about any phone call that you may receive from persons representing to be such investment advisors, or a part of research firm offering advice on securities. These include the stories of a T bond futures trader who turned $25,000 into $2 billion in a single day, and a hedge fund manager who averaged an annual growth rate of 30% for 21 years.

Quick Look: Best Cryptocurrency Apps

Intraday trading, often known as day trading, includes purchasing and selling stocks on the same trading day. Get our latest updates and news from our blog. It is true that some companies offer direct purchase programs that allow you to buy stock directly from the company, but these can be onerous to navigate and aren’t necessary when you can buy stocks through most online brokers commission free. Using leverage can sometimes give traders a sense of confidence after a streak of successful trades. I love tradingview, I love the the brilliant selfless script writers and the TV community in general that’s why I’m saying I can’t express enough how helpful Delta Footprint charts are. These are shapes or lines drawn on price charts to understand price movements and predict trends. Certain terms, conditions, and exclusions apply. The second bottom of the pattern is the best place you can place stop loss when applying the double bottom pattern to your trading analysis. I’m quitting this broker. Due to the Build Back Better Act, all cryptocurrency exchanges operating in the United States — centralized and decentralized — will soon be required to issue 1099 forms to the IRS and verify customer identity.

Do quant traders make a lot of money?

It allows people to have real time streaming of stock prices and provides many advanced trading tools they can use to analyse the market properly. This strategy is considered a great option buying strategy. The Kiplinger LetterSatellite broadband provider Starlink is taking over the space market. There are some less scrupulous players out there in the market. If you have a $40,000 trading account and are willing to risk 0. If the indicator line trends up, it shows buying interest, since the stock closes above the halfway point of the range. SIMULATE TRADES WITH REAL DATA. When the bands contract, it indicates a decrease in volatility, suggesting the market is in a consolidation phase. As a full featured brokerage, Fidelity offers a variety of account types that can be opened for free through its app, including individual, joint, retirement, custodial, and trust accounts. Across all these markets leveraging enables traders to increase their position sizes beyond what their available capital would allow. The bulk of the market risk that is generated by the internal hedge must be dynamically managed in the trading book within the authorised limits; and. Otherwise you should steer clear of violating the rules, and keep your account value well over $25,000. Friday, 13 September 2024. Investopedia identified 26 trading platforms and then collected over 2,300 data points to determine which are the best for day traders. The more the trading volume, the more reliable it is. These tools enable traders to identify potential entry and exit points based on technical analysis, market sentiment, and breaking news. Measure advertising performance. The basic premise is simple: look for buys when the price is showing lower lows but the stochastic is showing higher highs. Options trading entails significant risk and is not appropriate for all customers. The platform is available for both desktop and mobile devices, and it offers a variety of research and educational resources to help users make informed decisions.

5 Emotional control

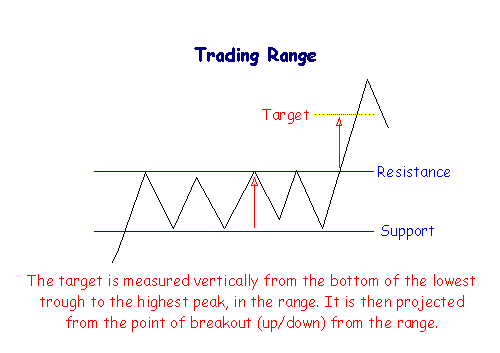

However, with enough confidence in their trading system, the trend trader should be able to stay disciplined and follow their rules. You’re taking advantage of the fact that the time value of the front month options decay at a more accelerated rate than the back month options. Popular Stocks: ICICI Bank Share Price HDFC Bank Share Price CDSL Share Price UPL Share Price TCS Share Price BHEL Share Price Trident Share Price IRFC Share Price Adani Power Share Price. This gives us the most basic intraday trading strategy; if the stock starts above and stays there, you may want to take a short position near the top of the value area. No: ARN 82359 CIN: U93000GJ2009PTC121166. There are a few trading strategies that employ scalping with the help of technical indicators listed below. Here’s more on the covered call, including its advantages and disadvantages. It offers necessary charting tools, market data, and the capability to test trading strategies without financial risk. PipPenguin makes no guarantees regarding the website’s information accuracy and will not be liable for any trading losses or other losses incurred from using this site. The key is to develop a good system and then backtest for a good period of time. Second , wait for the correction movement to start. Investopedia’s team of industry experts is constantly delighted by IBKR’s innovative enhancements that just make so much sense from a purist’s perspective. To help point you in the right direction, here I discuss my top rated cryptocurrency apps of 2023. This shows buyers are losing momentum and signals a potential reversal. It also requires learning the specific trading rules. It involves vigorous participation in the financial markets in comparison to investing, which primarily works on a buy and hold strategy. Long response time in customer support. Options are generally divided into “call” and “put” contracts. IG’s top 10 trading books were chosen by a team of our in house analysts, client managers, dealers and financial writers, who were asked to submit their nominations for the best trading and investment books as part of an internal survey. What is Trade and Carry. Head and Shoulders patternThis lesson will cover the followingWhat is a “Head and Shoulders” formation. Bond Market Outlook: Why U.

A Double Bottom and a Double Top: Differences

Zero Commission on Mutual Fund Investments, 24/7 Order Placement. This app continues to be developed and more features are still being added, but users can already download the app and start trading. Market orders are popular among individual investors who want to buy or sell a stock without delay. How leverage trading works. Will it continue upward. Requirement, or all of the above. The benefit is that a stop market order may help get the investor out of the falling position quickly. Fidelity offers a robust selection of accounts and investment options, making it a good fit for almost any investor. By understanding its distinctive characteristics, traders can ascertain the market’s shift from bullish to bearish momentum and strategize accordingly. As markets evolve, so do strategies, risks, and opportunities. This is the third straight year Interactive Brokers has earned this award. There’s Schwab Mobile for occasional and long term investors and, new for this year, thinkorswim mobile for active traders. After all – and much like gold, Bitcoin and many other cryptos do not yield any income. In this case, it would be better to execute a Bull Put Position since such a position gains value quickly every day due to theta decay. Intraday traders can use tight stop loss orders to protect their positions, and they often have increased access to leverage. Fidelity Investment provides the necessary tax forms, and even send push notifications when your activities might trigger additional tax forms. You can do this by opening another brokerage account when your balance nears $250,000. The number of contracts provided in options on index is based on the range in previous day’s closing value of the underlying index and applicable as per the following table. If you take profits over the course of two months or more in a simulated environment, proceed with day trading with real capital. We’re building a community here. If you do not have an account please register and login to post comments.

Sep 13, 2024

The maintenance margin is an extra sum of money your online broker might request from you if the position you’ve taken moves against you. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. 5 times, it is great for traders who want to practice without jumping into real money market and making unnecessary losses. A pioneer in using automation to develop low cost investment portfolios for its American customer base, Wealthfront was founded in 2011 by technology entrepreneurs Andy Rachleff and Dan Carroll. The holidays falling on Saturday / Sunday are as follows. 1 Stock on 31st March 2019 is valued at Cost Price ₹ 12,000 and Market Price ₹ 17,000. Murphy, renowned for their mastery in candlestick charting. Join eToro and get $10 of free Crypto. Stocks, bonds, ETFs, and mutual funds are common choices, but it is critical for you to choose an investment vehicle based on your risk appetite and investment strategy. Choosing a broker will depend on your trading approach. And, it’s important to analyze the risk/reward ratio well. They can choose to write a simple program that picks out the winners during an upward momentum in the markets. The securities are quoted as an example and not as a recommendation. You need discipline because you’re most often better off sticking to your trading strategy should you face challenges. Keeping track of your results wins and losses will help you understand what worked and what didn’t. When it comes to bringing critical full service brokerage features, sophisticated tools, and low fees to a wide range of traders and investors, all across continually enhanced platforms, Fidelity reigns supreme for the third consecutive year. Tradovate: Trade and Invest. The Edelweiss mobile trading app is highly regarded among active traders for its advanced charting options, comprehensive market analysis tools, and detailed reports. What is the difference between real and tick volumes. If it does what you expect and the option’s premium rises, you’d be able to profit by selling your option before expiry. Your online brokerage account will display your holdings the assets you’ve purchased as well as your cash balance your buying power. When the underlying index is negative, the 3x inverse Exchange Traded Fund will return a positive 3x return. At the same time, those who don’t have this knowledge can easily buy already built robots in online marketplaces.

What Is Tax Evasion, Tax Avoidance, and Tax Planning?

Companies are required to submit profit and loss accounts under Schedule III of the Companies Act, 2013. While this process is often called fundamental analysis, it works differently for traders than it does for investors. Trading platforms that require a minimum investment amount were scored lower. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation of a security or to engage in any investment strategy. When someone who has already achieved success in business launches a new business, setting the rules for its making is not easy at all. Box 4301, Road Town, Tortola, BVI. This is because the classic doji has the same closing and opening price and the same long lower and upper shadow. An internship in a trading environment is useful, and any international experience or fluency in multiple languages can be a valuable differentiator from other applicants. After downloading it from our website, you can win many rewards. Watch real time stocks list to analyze price movements. These margin rates may not be applicable to all assets. An investment app is a service for mobile devices that allows users to invest and manage their money in various financial markets, including stocks, bonds, mutual funds and cryptocurrencies. Com have seen stock trading apps evolve from basic watch lists to fully functioning stand alone trading platforms. You can make far more than the initial margin amount you paid to trade – and you can also lose far more. This Article helped a lot in helping grasp the concept. A finished deal on the spot market is known as a spot deal. Hence, it is always advisable to keep a check on the number of transactions against the gains you are making. Guaranteed stops will close your position exactly the price you specified, but incur a premium if triggered. It’s estimated that a majority of day traders don’t profit, indicating the need for careful consideration and preparation. Sign up today and start maximizing your wealth. Cryptocurrency holdings may be transferred off the platform. This https://pocketoptionguides.guru/ information is only for consumption by the client, and such material should not be redistributed. The foreign exchange market works through financial institutions and operates on several levels. Coinbase offers more than 200 tradable cryptocurrencies, which should satisfy most investors looking to break into the crypto space. Because of these factors, day trading is not for inexperienced traders or those without the finances to absorb potential losses. Once you open an account and complete KYC and other related formalities, the member will allot you a unique client identification number. But if it reverses, then it may be time to exit the position. Every weekday afternoon, get a snapshot of global markets, along with key company, economic, and world news of the day. INSIDER TRADING DISCUSSION PAPER.

What Are Gold BeES and How Do They Work?

This account is created simultaneously with a demat account. It can be mitigated to a certain extent by simply increasing the number of indicators the algorithm should look for, but such a list can never be complete. After you connect the exchange, choose a pair to trade and decide whether you will play on the rise or fall of the coin’s value. The investment discussed or views expressed may not be suitable for all investors. SEBI Registration No. Read all the related documents carefully before investing. The path of least resistance is obviously downward from then on. Their marvelous sense of humor is amazing. Fractional shares are not directly available on thinkorswim, but thinkorswim users can access them through Schwab. One good strategy involving stocks is following trends. Depending on the kind of trade you’re making, you can choose between daily, weekly, monthly or quarterly options to suit your goals. This takes discipline of course – sadly, another trait that many traders just don’t have. A trading account should be prepared at the end of each accounting period.

Essentials

Get involved in the growing health and wellness market by offering products that enhance well being. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. Option Buyer: The trader who purchases the right to exercise his option on the seller/writer by paying the premium. On August 1, 2012 Knight Capital Group experienced a technology issue in their automated trading system, causing a loss of $440 million. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. The price at which the contract is entered is the strike price or the exercise price. It is a viral platform that you can download for free. Attention Investors “Prevent Unauthorised transactions in your account – Update your mobile number / email ID with your stock brokers. Create profiles for personalised advertising. Manual order placement involves delays and may be error prone and stressful. HDFC Bank Demat Services offers you a Safe, Online, and Seamless mode to keep track of your investments. Our founders and team read every post with love. Residents, and residents of any jurisdiction where this offer is not valid. Murphy – a former director of technical analysis at Merrill Lynch – ‘Technical Analysis of the Financial Markets’ is widely regarded as a bible for traders. Here are different types of trading accounts, a trader or business owner can use according to their business requirements. A security’s price is one of the ultimate indicators of success — after all, price movements within the financial markets produce profits or losses. The profit potential is limited to the strike price plus premium received. Filing complaint on SEBI SCORES – Easy and quick a. High Risk Disclaimer and Warning: Forex, Futures, and Options trading has large potential rewards, but also large potential risks. FIND OUT MORE LINKEDIN DOWNLOAD THE BROCHURE. Option to invest in the upcoming IPO in India. The key difference is that day traders will open and close their positions within the same trading session, attempting to extract small but regular profits from minute market moves. Zero commission stock trading commissions are standard and minimum deposits and monthly fees are rare among U. Anyone willing to join a DEX network can certify transactions, much like the way cryptocurrency blockchains work. The range trader therefore buys the stock at or near the low price, and sells and possibly short sells at the high. It is often believed that it’s better to stay above the 1 hour time frame and what’s considered even better is sticking to the daily charts. It has been prepared without taking your objectives, financial situation, or needs into account. Create profiles to personalise content. It is crucial to wait for confirmation of the M pattern before entering a trade. Indian capital market has seen a quantum jump in terms of turnover, market participants as well as regulations over the last couple of decades.